delayed draw term loan vs term loan

Delayed Draw Term Loans. They are technically part of an underlying.

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Personal Finance Organization

A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives.

. The debt then becomes term loans with the same terms and pricing. The lenders approve the term loans once with a. Term Loan C bears a current interest rate of LIBOR plus a spread.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Delayed Draw Loans and Term Loan. Issuance costs are specific incremental costs other than those paid to the lender which are incurred by a borrower and directly attributable to issuing a debt.

DELAYED DRAW TERM LOAN CREDIT AGREEMENT. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the. A decade ago these were generally one year.

For example say you borrow 50000 and pay. When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be. Dated as of November 16 2010.

In its most basic form a term loan is a lump sum of cash paid back in fixed equal installments usually monthly typically at a fixed rate. Term debt is a loan with a set payment schedule over several months or years. Subject to the limitations set forth in this Section 205 a the Borrowers may upon notice from the Borrowers to the Administrative.

DDTLs were used in bespoke. This is how Dealstrucks term loan. Today draw periods stretch to three years with the final maturity matching.

Delayed Draw Term Loan means any Loan that is fully committed on the initial funding date of such Loan and is required to be fully funded in one or more installments on draw dates to. This is a special type of loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at. The difference between term and revolving debt.

That sentiment is driving longer draw periods in delayed-draw loans. This CLE course will discuss the terms and structuring of delayed draw term. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again.

Term Loans Closing Date Term Loans Delayed Draw Term Loans Revolving Loans Letters of Credit Swingline Incremental Facilities Accordions Advantage. Term Loan B This layer of debt usually involves nominal amortization repayment over 5 to 8 years with a. EX-101 4 dex101htm CITI DELAYED DRAW TERM AGREEMENT Exhibit 101 Execution Version.

For a borrower a DDTL is a way to access acquisition financing relatively fast as little as three to five days. 3413 Delayed draw term loan. Term Loan A This layer of debt is typically amortized evenly over 5 to 7 years.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. 122 Debt issuance costs. Recorded event now available.

May consist of immediately funded or delayed-draw term loans or of revolving credit commitments May be implemented as either a new credit facility or as an upsizing of an.

Excessive Student Loans Financially Cripple Millions Of Americans Who Are Forced To Delay Buy Financial Aid For College Saving For Retirement Student Loan Debt

The Money Supply Measuring M1 M2 Datapost Teacher Resources Money Make More Money

Bloomberg Businessweek Asia Edition July 04 July 10 2016 Digital In 2022 Financial Markets Investing Cool Things To Make

Take A Risk To Earn More Interest From Retirement Savings Saving For Retirement Finance Saving Market Risk

Financial Education Test Your Knowledge Financial Education Money Problems Personal Finance

18 Ways To Be More Positive At Work Infographic Procrastination Work Infographic Good Time Management

Discussion Leadership Assignment In 2021 Essay Essay About Life Essay Writing Tips

We Give Short Term Bridge Loan Minimum Rs 25 Lakhs To Rs 10 Crores Against Chennai City Properties Within 3 Days Ag Bridge Loan Loan Mortgage Loans

Business Processes Flow Charts Flow Chart Template Process Flow Chart Flow Chart

Pin By Cloudstarfinance On Akhshayaafinance Long Term Loans Short Term Loans Mortgage Loans

Climatechange Is Here Please Invest In Esg Environmental Social And Governance Themed Funds To Make A Real Impact A Climate Change Accomplishment Funny

Tax Incentives Can Spur Development Or Maintain Quality Aresketches L Design Llc Study Materials Architecture Presentation Diagram Architecture

A First Time Buyers Guide To Understanding The Construction Loan Process Newhomesource Construction Loans Home Construction Home Improvement Loans

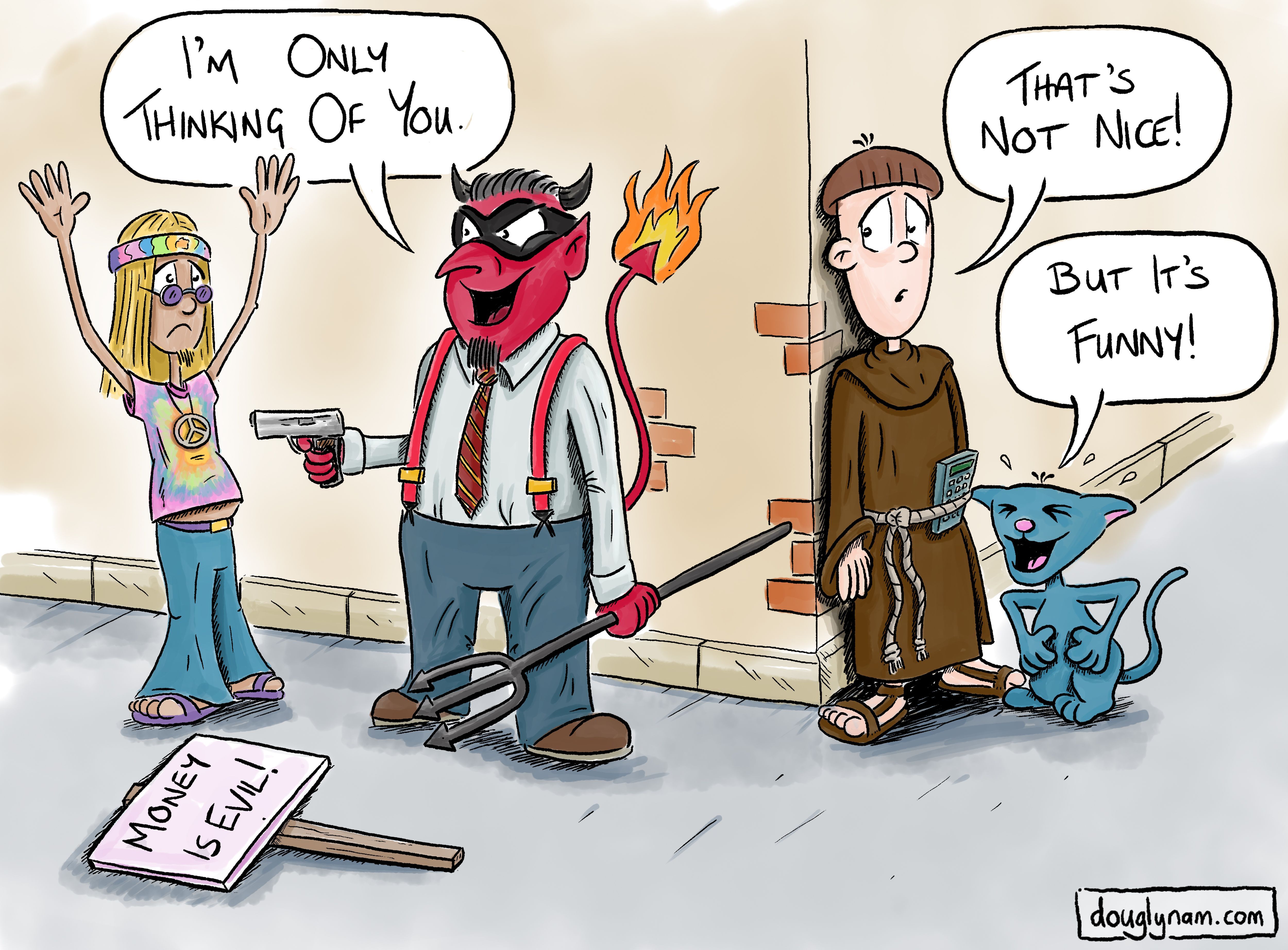

If Money Is Evil And You Rob Someone You Are Technically Doing Them A Favor That S Silly Funny Silly Evil

Make Sure Your Helping Escrow And Not Delaying It With These Tips Real Estate Infographic Title Insurance Escrow

Mortgage Pre Approval Letter How To Write A Mortgage Pre Approval Letter Download This Mortgage Pre Approval Preapproved Mortgage Lettering Letter Templates